cayman islands tax treaty

Japan Highlights 2020 Page 3 of 10 Participation exemption There is no participation exemption in respect of capital gains but there is a 95 foreign dividend exemption see above under Taxation of dividends. Refer to Resident Alien Claiming a Treaty Exemption for a Scholarship or Fellowship.

Lowtax Global Tax Business Portal Double Tax Treaties Introduction

Unilateral tax credits are also available for Kenyan citizens.

. The lack of effective exchange of information is one of the key criteria in determining harmful. PwCs State and Local Tax SALT practice can help you with strategies to manage your state and local tax issues by recommending solutions that are consistent with your companys overall business objectives. We can also identify appropriate tax treatment that is consistent with good business practices and states applicable tax laws and.

Select a rating to let us know how you liked the application experience. The foreign tax treaty also applies if you worked in the US. In addition you also need to check if you have tax obligations in the country you earned your income or resided during 2021.

This report reflects the outcome of the fourth peer review of the implementation of the BEPS Action 6 minimum standard on treaty shopping. The foreign tax relief is calculated using a specific formula. US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to foreign persons.

Our team is here to help you navigate your US. Users may rely on this list in determining deductibility of their contributions. It takes effect in the British Virgin Islands from 1 January 2011 and in the UK from 6 April 2011.

Kenya has DTTs in force with the following countries. American Samoa the Commonwealth of the Northern Mariana Islands or the US. With secure online tools experts at the ready and a library of resources to boost confidence we give you everything you need to solve any tax challenge.

For eg in the US and India tax treaty. Incentives Various tax credits are available including an RD credit. Organizations eligible to receive tax-deductible charitable contributions.

Under the BEPS Action 6 minimum standard on treaty shopping members of the OECDG20 Inclusive Framework on BEPS have committed to strengthen their tax treaties by implementing anti-abuse measures. New Zealand has a network of 40 DTAs in force with its main trading and investment partners. The Double Taxation Agreement entered into force on 12 April 2010.

Organizations whose federal tax-exempt status was automatically revoked for not filing a Form 990-series return or notice for three consecutive years. The national interest analysis is published as part of the Select Committee report back to the House and links to these reports are included on each countrys tax treaty web page. This is especially true when there is an international or overseas aspect involved.

Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income. The agreement grew out of the work undertaken by the OECD to address harmful tax practices. Holding company regime There is no holding company regime.

A statement that you are relying on an exception to the saving clause of the tax treaty under which you are claiming the tax treaty exemption. Tax needs from start to finish. Summary of US tax treaty benefits.

If you are not a student trainee teacher or researcher but you perform services as an employee and your. Virgin Islands you must pay taxes on your net earnings from. Cayman Islands Cyprus Isle of Man Malta Mauritius the Netherlands Antilles the Seychelles and San Marino.

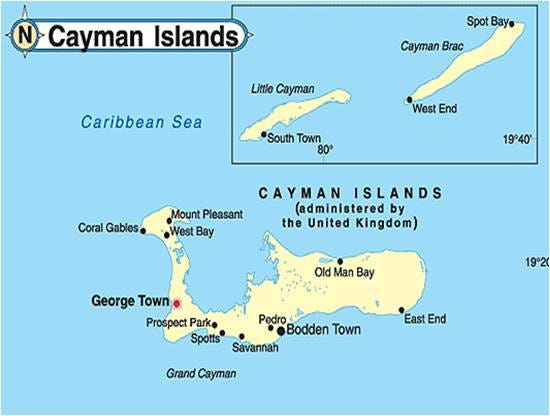

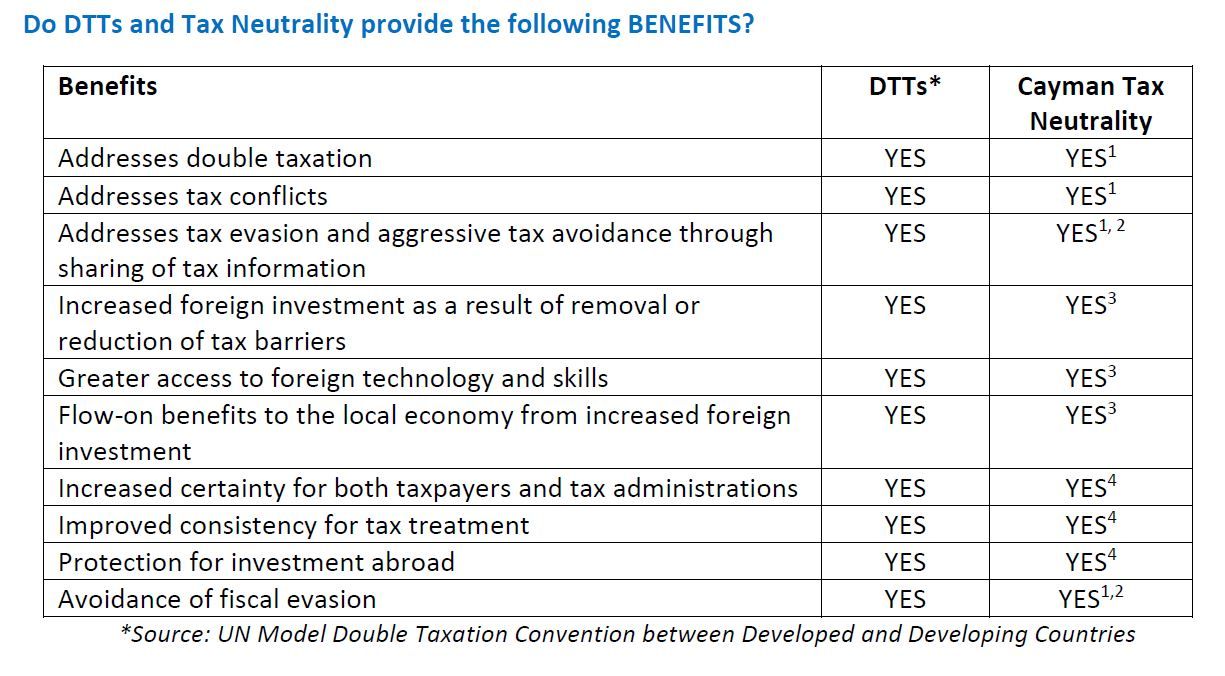

Foreign tax credits are claimable where there is a Double Tax Treaty DTT between Kenya and the other tax jurisdiction. The Cayman Islands ˈ k eɪ m ən is a self-governing British Overseas Territory the largest by population in the western Caribbean SeaThe 264-square-kilometre 102-square-mile territory comprises the three islands of Grand Cayman Cayman Brac and Little Cayman which are located to the south of Cuba and northeast of Honduras between Jamaica and Mexicos Yucatán. DTAs reduce tax impediments to cross-border trade.

The relief can be claimed only when the foreign taxes are paid in a final way by filing the Italian tax return. In case of double taxation of the same income between Italy and a foreign country the individual can claim foreign tax relief for the taxes paid abroad.

15 Top Tax Havens Around The World Thinkadvisor

An Overview Of The Cayman Islands By Ben Hinson Countries Around The World

How To Move Your Business To Cayman And Pay No Tax Escape Artist

Cayman Islands Beats Mauritius Fdi Into India Surges To 2 1 Billion Businesstoday

An Overview Of The Cayman Islands By Ben Hinson Countries Around The World

Cayman Islands Government And Society Britannica

Here Are Some Of The Most Sought After Tax Havens In The World

Why Coronavirus In Cayman Risks Brazilian Offshore Assets By Matthew Feargrieve Medium

What Makes Cayman Islands So Popular For Hedge Funds International Finance

Registration Of Company In Cayman Islands Offshore In Cayman Islands Company Registration For Business Purposes Law Trust International

Cayman Islands Introduces Beneficial Ownership Register Regime Vistra

Cayman Islands And Cryptocurrency Blockchain And Cryptocurrency Regulations

A Guide To Cayman Island S Taxation System Zegal

Cayman Islands Tax Neutrality Overview Tax Authorities Cayman Islands

Cayman Islands Offshore Companies And Services Offshorecircle Com

A Cloudy Day In Paradise For Pharma Tax Havens In Cayman Islands Bermuda Impact Of Oecd Tax Deal On Pharma In Cayman Islands And Bermuda Tax Haven

Letter From Brussels Pressure Builds On Tax Havens Analysis Ipe

/CIA_map_of_the_Caribbean-822e94431d4647ba9ca350ebf28eb23b.png)